30+ Fast track mortgage calculator

30 Fast track mortgage calculator. This mortgage payment calculator helps you to find out how you can fast track the payment of your mortgage loan with our Home Cre Minggu 04.

Best 10 Loan Calculator Apps Last Updated September 13 2022

Discover Your Estimated Mortgage Payment With This Simple And Straightforward Calculator.

. For example if you are 35 years into a 30-year home loan you would set the loan term to 265 years and you would set the loan balance to whatever amount is shown on your statement. A fast-track mortgage is a way for you to speed up this process. The amount you first.

5 10 and 20 deposit options showing potential savings and potential future wealth by entering the market. A mortgage calculator can help you get a realistic idea of the type of home you can afford. Estimate how much you can save and how much equity you can create.

See how changes in your payment can affect your payoff time. This calculator compares AffordAssist against other. Repayment Amount Input your principal your annual interest rate and the number of years and click the.

When you take a mortgage of 100000 for 30 years at 5 interest you will pay a total of 93255 just for interest. For all the calculators the interest rate is input as a percentage eg for 7 input 7. For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest.

5 and 10-year terms available. The length of your original mortgage in years. The premium for the insurance policy for FHA loans and conventional mortgages if your down payment is less than 20.

The interest paid is your earnings after taxes. Original mortgage term. Total of all interest paid over the full term of the mortgage.

Best Mortgages In Canada Comparewise. Please note that the interest rate is different from the Annual Percentage Rate APR which includes other expenses such. In Australia the mortgage process typically takes about 12 weeks from start to finish.

Both 30-year fixed and 15-year fixed mortgages are shown. Terms of 15 20 and 30 years are most common. PMI typically costs between 05 to 1 of the entire loan amount on.

Information and interactive calculators are made available to you as. Pay off your mortgage in 5 or 10 years at a low fixed rate by refinancing to an Addition Financial Fast Track Mortgage. 250 off closing costs.

The annual interest rate used to calculate your monthly payment. 30 Year Mortgage Calculator. 20000 in interest savings is.

The Rocket Mortgage calculator estimate shows principal and interest and has the. Using our Citi Home Credit Mortgage payment calculator you can check how the Home Credit facility can help you fast track your loan repayment and reduce mortgage interest costs.

What Would My Yearly Salary Have To Be To Afford A 2m House Quora

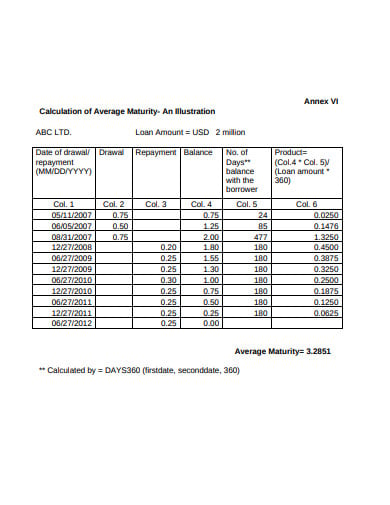

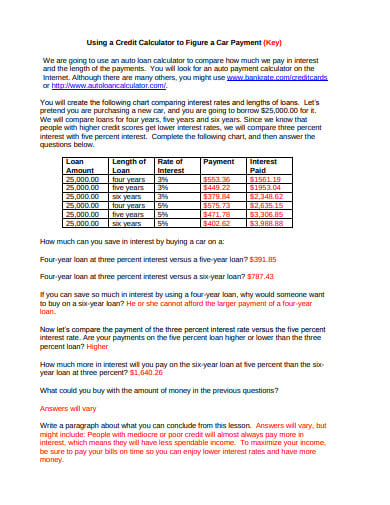

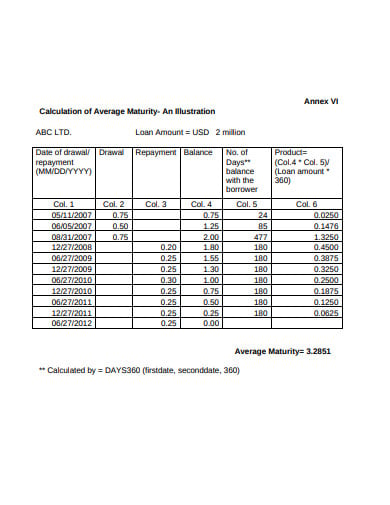

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

![]()

Best 10 Loan Calculator Apps Last Updated September 13 2022

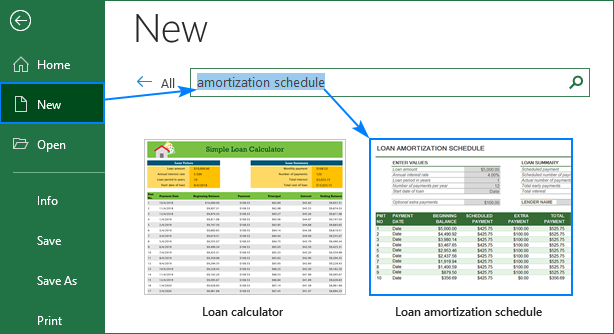

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

Best Mortgages In Canada Comparewise

Hsbc Fixed And Variable Mortgage Rates Sep 2022 From 4 94 Wowa Ca

Best 10 Loan Calculator Apps Last Updated September 13 2022

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

Best Mortgages In Canada Comparewise

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Being A Landlord Rental Property Management

Direct Credit Home Loans Tailored Residentail Commercial Loans Direct Credit

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed