Hr payroll calculator

Ad Process Payroll Faster Easier With ADP Payroll. Heres a step-by-step guide to walk you through.

What Is Payroll And How Are Payroll Calculations Done

17 rows There are two paycheck calculators that compute paychecks for employees in Illinois and New York.

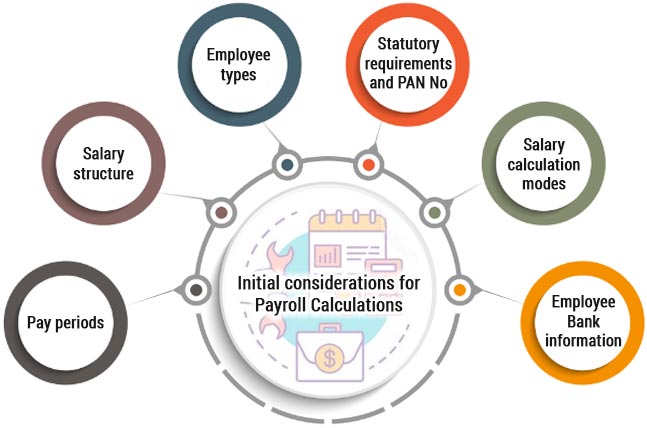

. Ad Learn How Heartland is Powering Americas Small Business Renaissance. Payroll calculations usually constitute 4 main components Basic pay Allowances Deductions and IT Declarations. Get Started With ADP Payroll.

Get a free quote today. A payroll or paycheck calculator is a tool that calculates tax withholdings and other deductions from an employees gross pay which makes it easier to give your employees. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Print our hourly wage calculator A new. Household Payroll And Nanny Taxes Done Easy.

This calculator is only to be used as an estimate your actual take home pay is calculated by. A Hourly wage is the value. Household Payroll And Nanny Taxes Done Easy.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. On top of a powerful payroll calculator HRmy also offers.

Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. Well Do The Work For You. - In case the pay rate is hourly.

1Use Up Arrow or Down Arrow to choose between AM and PM. Then multiply that number by the total number of weeks in a year 52. For example if an employee makes 25 per hour and.

Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

Plug in the amount of money youd like to take home. How Payroll calculations are done. Ad With world-class global hiring and payments our competitors dont come Remote-ly close.

- English and French. The Best Online Payroll Tool. Free Unbiased Reviews Top Picks.

The maximum an employee will pay in 2022 is 911400. Below is a sample payslip generated by HRmy. - All provinces Including Québec - CRA and Revenu Québec remittance information.

Ad Accurate Payroll With Personalized Customer Service. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

BTW Payrollmy PCB calculator 2020 is powered by HRmys payroll calculator. 2Enter the Hourly rate without the dollar sign. Ad Compare This Years Top 5 Free Payroll Software.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. Ad Payroll Done For You.

By accurately inputting federal withholdings allowances and any relevant. - Net to Gross pay. Forget email support get real help quickly with 247 in-app support thats Deel speed.

Get a free quote today. It will confirm the deductions you include on your. Customized Payroll Solutions to Suit Your Needs.

For example if you earn 2000week your annual income is calculated by. Well Do The Work For You. Canadian Payroll Tax Calculator.

Multiply the hourly wage by the number of hours worked per week. Utilize the Paycheck Calculator to obtain an ESTIMATED take home pay based on your inputs. If you have questions about Americans with Disabilities Act Standards for.

Everything You Need For Your Business All In One Place. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. GS-12 is the 12th paygrade in the General Schedule GS payscale the payscale used to determine the salaries of most civilian government employeesThe GS-12 pay grade is generally held by.

Here When it Matters Most. All inclusive payroll processing services for small businesses. All Services Backed by Tax Guarantee.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Calculating Payroll For Employees Everything Employers Need To Know

Time Calculator For Payroll Hot Sale 57 Off Www Ingeniovirtual Com

Salary Formula Calculate Salary Calculator Excel Template

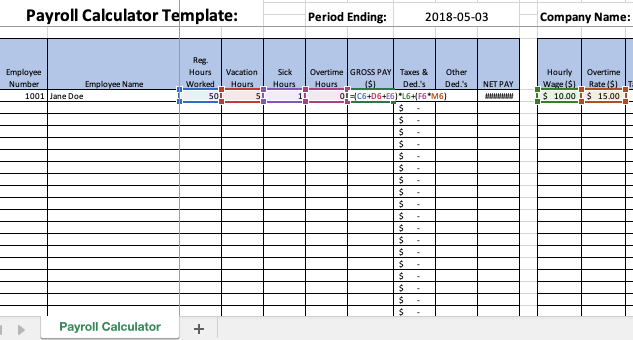

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Salary Formula Calculate Salary Calculator Excel Template

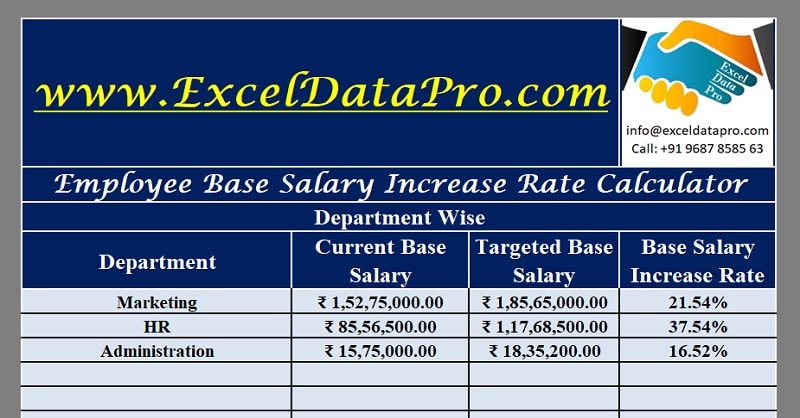

Download Employee Base Salary Increase Rate Calculator Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Employee Payroll Calculator Officetemplates Net

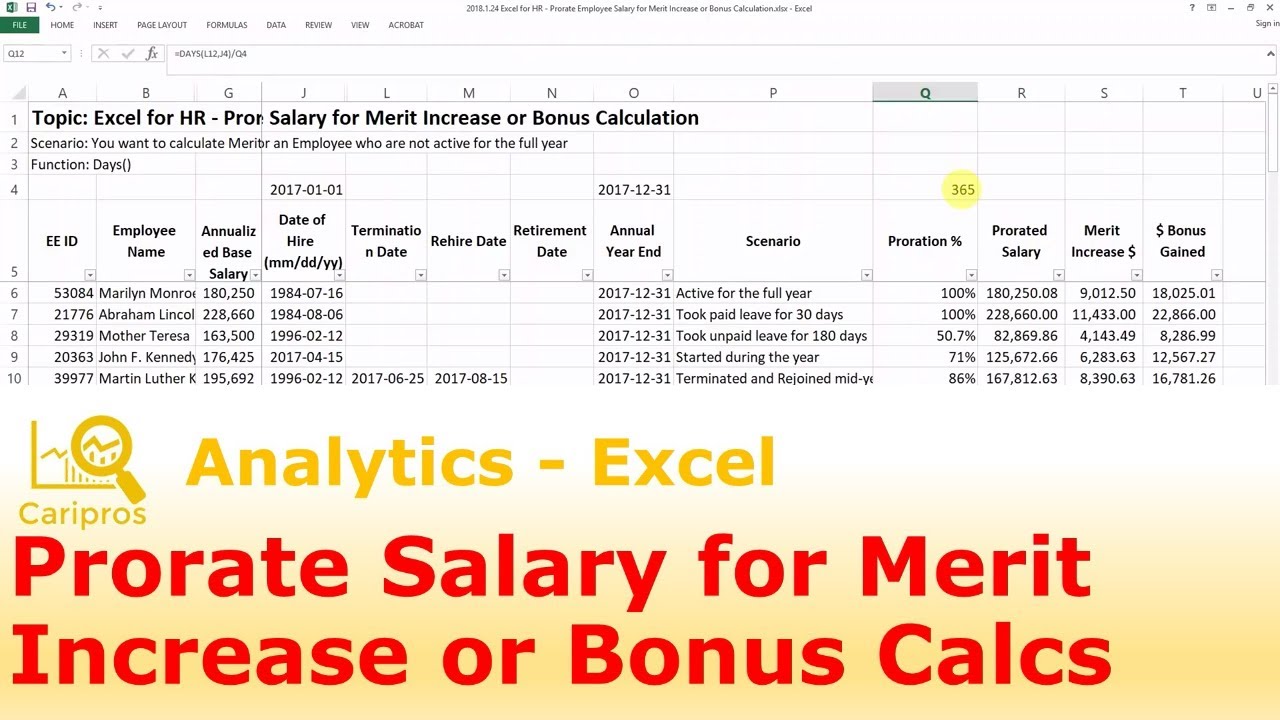

Excel For Hr Prorate Employee Salary For Merit Increase Or Bonus Calculation Youtube

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

10 Common Payroll Management Mistakes To Avoid

Excel Payroll Formulas Includes Free Excel Payroll Template

Payroll Formula Step By Step Calculation With Examples

Excel Magic Trick 629 Hr Salary Calculation Based On Relevant Years Worked 2 Methods Youtube

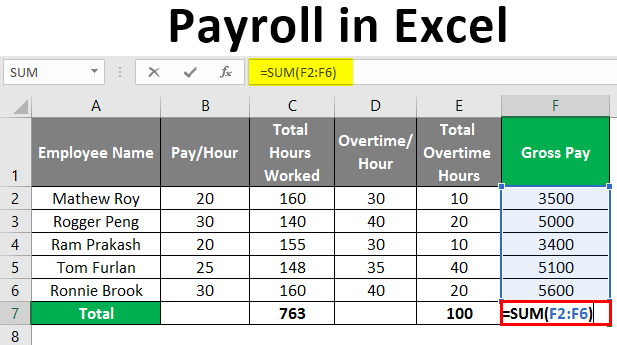

Payroll In Excel How To Create Payroll In Excel With Steps

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Payroll For Hourly Employees Sling